In this guide I will reveal how to sell your wine in China based on market surveys by Daxue Research. Italian wine in China is an important reality and you too can be a player in this market! I would like to say that this is the longest and most comprehensive guide ever written in Italian on the web on the sale of Italian wine in China. 🙂 🙂

We will analyse the Rhône Valley case study together, starting with the market situation and working out the strengths of the competitors, we will discover how the main Chinese ports are viewed by the Chinese themselves and the tastes of the different segments, and finally we will study the resources available and 'copy' the marketing strategies that are successful.

If you still haven't managed to break into the Chinese market, or you haven't thoroughly studied who has made it, or you are doing something wrong... let's find out together 🙂 🙂

Before we begin, let me tell you why I decided to write this guide and thanks to whom I obtained this information, which represents an extraordinary opportunity for you!

Daxue Research is a major Chinese company with bases in Beijing, Shanghai and Hong Kong that deals with market research using an international team; its clients include Samsung, Carrefur, Inter Rhône, PayPal, Marc Jacobs, the Swiss Government, the Mexican Government and the European Union (just to name a few) and is covered by the Financial Times, Le Monde and other newspapers around the world. That's why when Greta Pogliani, a student at the University of Milan - Bicocca who works for Daxue Research contacted me to send me the report of a survey on wine sales in China, hoping to offer me an interesting starting point for an article in this blog, I was really pleased. Luckily the report was in English... 🙂 🙂

The survey, commissioned by Inter Rhône and financed with the support of theEuropean Unionwas coordinated by a team of international professionals:

The survey, commissioned by Inter Rhône and financed with the support of theEuropean Unionwas coordinated by a team of international professionals:

- Matthieu David – Ceo Daxue Consulting

- Cindy Chen - Junior Consultant Daxue Consulting

- Clément Mougenot – Daxue Consulting

About a month ago I wrote a small summary on wine in China read it before continuing.

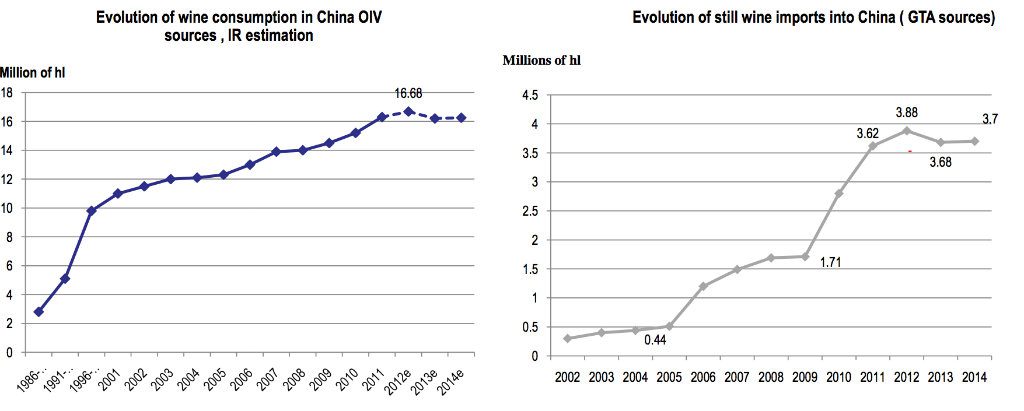

The wine market and the volume of imports have both experienced sustainable growth since 2002. According to the interviewees, after a steady growth, the market slowed down in 2013 due to political decisions and especially anti-corruption policies. The government also negatively affected sales of luxury wines. Despite this, it is estimated that the Chinese market is around 17 million hectolitres. In 2013, there was also a decrease in the volume of imports from 3.88 million hectolitres to 3.7. It should be noted, however, that this figure is not so significant as it can be read as a normal 'settling' of the market, which had experienced exponential growth between 2009 and 2012 due to the fact that during this period the Chinese population had begun to learn about and become interested in foreign wines to the point of starting to buy them.

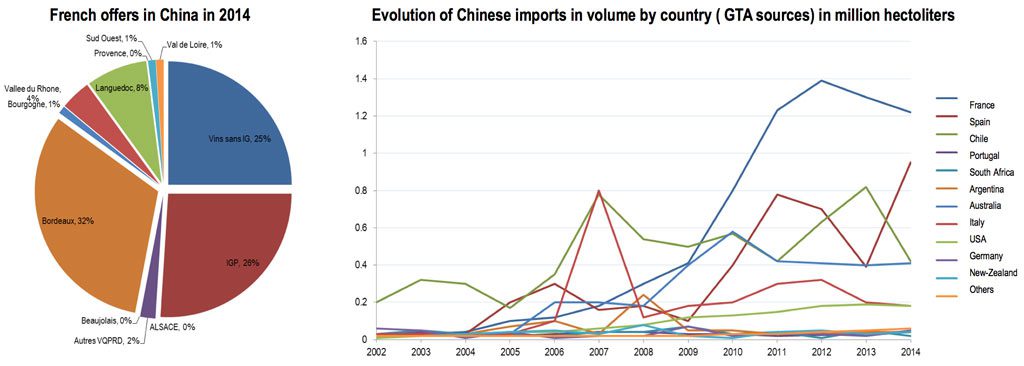

Australia has the highest export prices in the world and remains stable at around 4.76 €/litre, compared to the lowest price of Chilean wine which is around 1.39 €/litre. Analysing the export price of all countries, the average price is 2.93 €/litre, where Italy ranks 4th after the USA (3.3 €/litre) and France (3.66 €/litre) with 3.32 €/litre. Since the most exported wine in recent years is Bordeaux, perhaps it would be appropriate for Italian producers who also produce this type to concentrate on the export of Bordeaux-style wines?

Click here for more information

However, in general, the volume of exports decreased a lot after 2012, including Bordeaux. Only wines without PGIs have continued to grow from 2012 until today. I explain this by recalling that China has only recently started to approach the concept of quality, and the culture of quantity and low price at the expense of product is still ingrained in the Chinese.

Market research has shown that the wine market in China is undergoing a major restructuring: from high-end to mid-range. This greatly affects the best-selling wines, which are:

- Bordeaux - for about 30% of the respondents is the Wine Best Selling. This product is in high demand by the end consumer because it is easy to sell as it has a famous name. Wine professionals sell it in all price ranges, from low to high.

- French Wines - To the simple question "Which wines have sold best in the last two years?" the answer could only be "French wines". This generic answer is explained by the fact that wine professionals are more inclined to talk about the nation of origin (France, Italy, Spain...) than the individual region (BordeauxTuscany, Andalusia...). This result also means that French wines sell better than any other wine also because of the image of France as a nation at the TOP of quality wine production.

- Australian wines - I honestly did not expect Australian wines to be in third place in the top selling wine products. This is explained by the fact that Australian wine agencies have an active presence in China and carve out their share of the market with a large communication presence through the various events, exhibitions, mass advertising (taxis, metro...)... In addition, the Australian wine industry is enjoying the investment of the entire tourism agency, which also has a very busy business in China. Dulcis in November 2014 China agreed to drop trade barriers on Australian wine.

And the Italian wines? As always, Italy is very good at making products and very bad at advertising them... it is the never-ending story of the Italian people, its workers and its rulers: it is not enough to produce quality wine: even the BEST PRODUCT, if it is not placed on a pedestal in the market through marketing and communication, DOES NOT EXIST.

Let us learn from France, whose wines occupy two positions out of three! And above all, let us keep an eye on Australia, which, despite having a worse average product than Italy, is already more present in the Chinese market and should be closely monitored by the oldest wine producers in the world. This data still points out that due to increased consumer education and China's new anti-corruption laws, although the global wine market is growing, it is more difficult to sell wine, and the supply is rapidly changing from luxury to mid-range wines. I personally believe that this is because wine has gone from being a luxury good reserved for the few to a consumer good. As a result, the minimum culture in this regard has increased and the price range has decreased: since 2012, not only great wines are drunk in large restaurants, but mid-range wines are drunk in private homes.

Case study: Rhône wines in China

(Rhone Valley wines in China)

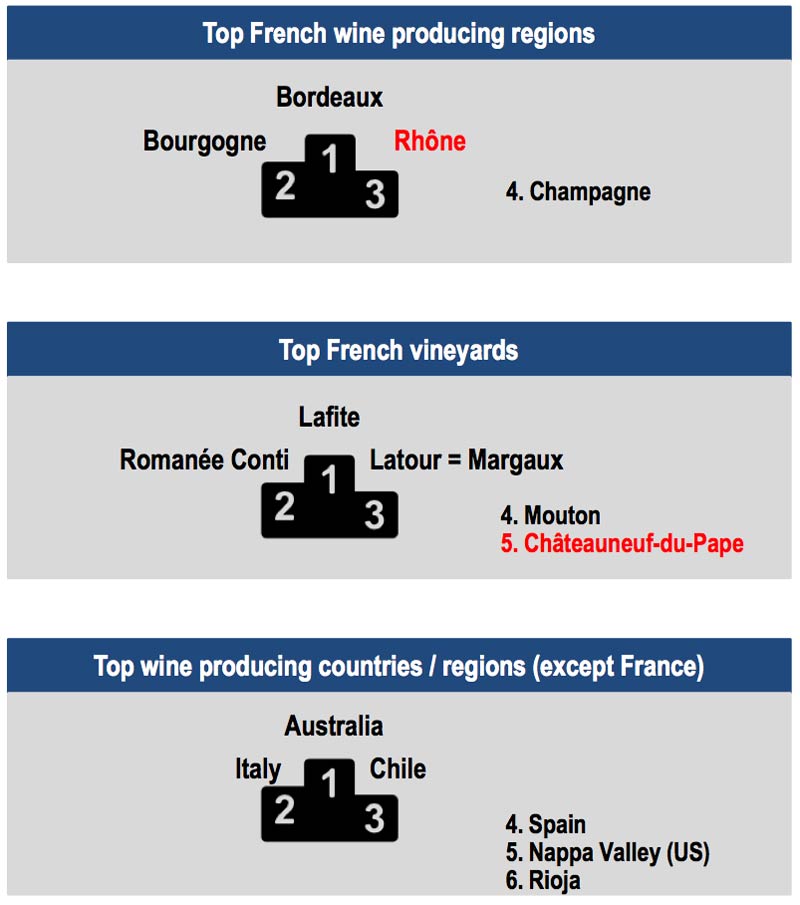

Unexpectedly, Champagne is 'only' in 4th place in the recognised French wine producing regions. This is because after 2012 Rhône gained 3rd place to become a good way for distributors to differentiate themselves from the competition by offering wines not particularly well known to the final consumer, with high quality and special taste. Lafite maintains its position as the leading French vineyard recognised by Chinese wine professionals. Surprisingly, Latour and Margaux lost one position to Romanée Conti, which came in second. Chateauneuf-du-Pape (which I tasted for the first time in Voluptates 2015) gained a lot of visibility among Chinese wine professionals and rose from eighth to fifth position. The overall ranking for other wine producers is the same as in 2012 and Australia is the country that comes to mind most when talking about wine right after France. As for the wine producing nations, it should be noted that if in the total of responses we include Spain with its Rioja and the USA with its Napa Valley their score would be very similar to that of Italy and Chile would not be in third place. Rioja's score (6th place) in particular is very interesting because it was not even mentioned in 2012: thanks to the intense promotional campaign developed by its associations over the last 2 years!

The growth of the wine market in China has mainly benefited French wines and in particular the Rhône Valley gained great popularity. Most other regions did not perform well, not even Australia, Italy and Chile. Bordeaux occupied 32 % of the French offer in China. It is striking that Burgundy, despite being the second most popular region, has only occupied 1% of the market in the last 2 years... similarly, Languedoc, which occupies 8% of the French wine offer in China never made it into the top 3 positions between 2012 and 2014. As for the Rhône Valley the offer is around 4 %.

Côtes du Rhône is the best-selling product among the professionals interviewed (sold by about 1/5 of the Chinese employees). However, Châteauneuf-du-Pape, the 2012 champion, seems to be losing market share to Côtes du Rhône and is in second place. Hermitage has won market share over Côte Rôtie and has become the third Rhône Valley wine sold by the Chinese wine traders interviewed.

Côtes du Rhône is the best-selling product among the professionals interviewed (sold by about 1/5 of the Chinese employees). However, Châteauneuf-du-Pape, the 2012 champion, seems to be losing market share to Côtes du Rhône and is in second place. Hermitage has won market share over Côte Rôtie and has become the third Rhône Valley wine sold by the Chinese wine traders interviewed.

After a sharp drop in 2013 (- 33%) there was a significant recovery in 2014 (+ 49%) for exports of wines from the Rhône Valley. Among the different types of wines in the area, the Côtes du Rhône is both the most exported and the most sold. The Costieres de Nimes is among the most imported wines and has continued to grow in the last two years despite not being very popular in China. Even though Châteauneuf-du-Pape is much more expensive than the average price of other Rhône Valley wines, it is in the top 3 of sales. This is because its story is well communicated and careful promotion has increased its perceived value with the result that Chinese customers believe it is absolutely worth buying.

This concept must be firmly imprinted in the minds of Italian wineries: the average consumer buys the story of the bottle even before its contents. The communication of the family history, the graphic care of labels and packaging, and online involvement are therefore fundamental to ensure that real value is surpassed by perceived value or that at least these two coincide in such a way that the consumer chooses the wine of that producer over another.

The Lady in Red campaign by Côtes du Rhône

Some associations are clear in the minds of Chinese wine professionals. For example, 50 % of the interviewees associate Rhone Valley wines with the colour red. The advertising campaign launched through events, tastings and exhibitions 'Lady in red' was mentioned several times during the research and had a positive impact on respondents, especially in the Shanghai and Guangzhou areas. Lady in red appeared on posters, commercial TV and websites. However, it remains difficult for professionals to give a precise description of the taste or image of Rhone Valley wines. 'Vigorous' and 'Elegant' are the two notable characteristics that came up in several responses. Interestingly, 1/4 of the respondents described these wines as 'spicy'.

What is certain is that the Lady in Red advertising campaign conveys vigour, elegance... and a bit of seductive piquancy, and is positioned as an extraordinary and successful communication piece.

"The lady in red is dancing with me Cheek to cheek There's nobody here" Chirs de Burgh"

In summary, for Rhone Valley wines, price is a major incentive while taste and quality are two recognised characteristics. Traders also mentioned the valuable and unique history of the Rhone Valley as an incentive to purchase its wines.

"Tell a real story as if it were unbelievable" Pavese

In China, the price factor is still decisiveHowever, the oenologists emphasised the need to educate wine professionals on value for money in order not to use the highest profit as a criterion for choice. An important theme that was touched upon was the need to educate the end consumer about these wines in order to increase demand for them.

As far as competitors are concerned, thanks to the work of the Bordeaux wine agency, Bordeaux wine enjoys a luxury image that the trade uses to sell it. In addition, the end consumer knows and demands the product and this generates large profits for local distributors, who consequently prefer to sell it instead of Rhone Valley wine. Australian wines are positioned differently to Bordeaux wines because they are said to be very similar in taste to Rhone Valley wines and wholesale import prices are generally much lower than those of Rhone Valley wines and for this reason local distributors tend to have a large selection of Australian wines. It is also for these reasons that Languedoc and Chilean wines are chosen as complementary or substitute products.

Half of the respondents know Côtes du Rhône and about 60 % of the professionals import and sell it. The professionals who know it consider it to be a wine with high value for money, good packaging and a good brand image, but since it is not recognised by the end consumer they think it is suitable for a niche market.

Hong Kong Harbour

In terms of preferred import channels, the port of Shanghai is the winner. This result could be influenced by the fact that 25 respondents work in this market, but it is easier to think that due to the large volumes of business, the tariffs for wines here are very low. For some respondents, Hong Kong remains the preferred port for luxury wines, but there is no interest in the arrival of mid/low-end wines where affordability, speed and efficiency with direct importation is required. About half of the professionals interviewed (65 out of 140) think that Hong Kong does not play as important a role as before. Industry professionals interviewed prefer direct importation from the country of origin to the port of Shanghai, while consumers prefer indirect importation as they like to get in touch directly with wineries and producers, or have their products shipped directly to Hong Kong.

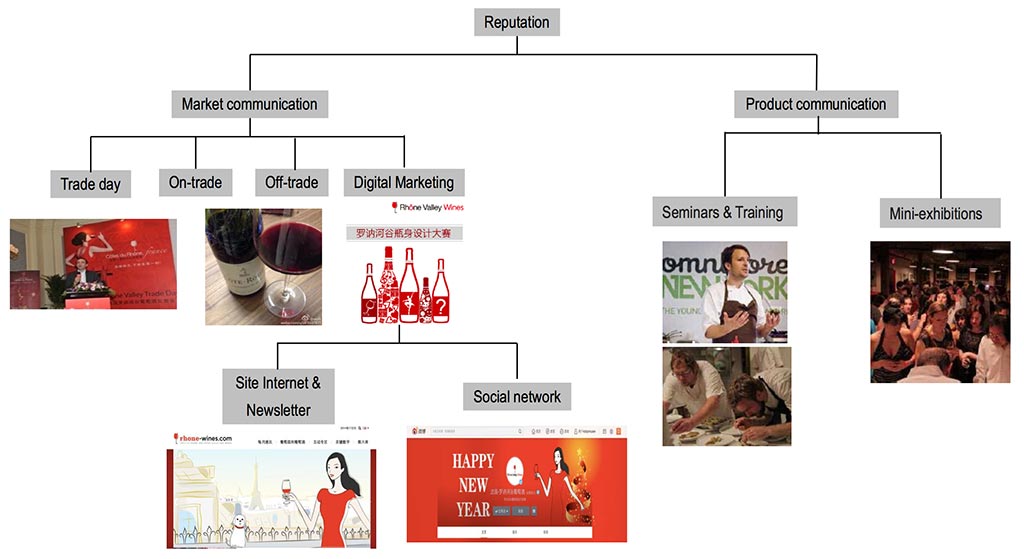

Brief Report on TOP Promotional Activities in China

Bordeaux, Australia and France are the regions that best remember the wine professional. Chile and Spain do well. Rhône is only 10th in the ranking and seems to lack visibility towards wine professionals interviewed, many of whom have never attended one of their events.

Tasting is the promotional activity that most marks the trade, but the classic exhibition is also important to consolidate brand differentiation and presence. Most people think that tasting is boring, so there is a need to innovate the process. However, there is a growing tendency for more targeted activities such as masterclasses, seminars, conferences... to discover new wines, to get to know the different players, managers, distributors and producers and to compare wines. This point is considered by all wine professionals to be very important! Master Classes are very popular among professionals, so organising training on a regular basis is very important. Touring tours are very important when producers enter the market. Mini conferences are aimed at a small audience but have a great resonance thanks to the presence of industry specialists and/or investors... the important thing is that the right personalities are invited! The newsletter is not frequently used, but it is very convenient for communicating directly with actual and potential customers. All wineries should develop a professional Newsletter to increase their business.

Rhone Valley brand development strategy in China

For a company operating in the wine sector, the website is an excellent tool. The proportion of professionals visiting the InterRhône website has increased over the last 2 years, especially the English, French and Chinese versions. There is, however, ample room for improvement as the average number of visits is about 1 per month. Among the professionals who sell Rhone wines, only 40% go to the website because they are in close contact with the agency, producers, importers and are not in the habit of opening the website to obtain product information.

As a web designer, I analysed the website of InterRhône and unfortunately I found many critical aspects in it:

- Not very elegant graphics and not at all in line with the seductive Lady in Red campaign that has been so successful in the Chinese market;

- Layout a little poor: not very articulate and yet not easy to read;

- The layout and graphics of the website seem more suited to a children's site: too many childish drawings... children don't drink wine!

- The blog is abandoned and the articles are mostly celebratory: self-celebration rarely contributes to concrete results on the web;

- The design of the site is just wrong: the objective of InterRhône is to promote the Rhône Valley and it is not user-friendly at all. Also questionable is the choice of pages to do so.

- it is clear that this site does not drive web traffic and consequently fails in its objective of strengthening the InterRhône brand.

A corporate website that works tells a story, stirs emotions and at the same time simplifies the user's life or helps him solve a problem.

Among the respondents who use the website in the different languages, it is said that this, as it is, is useful, especially the paper for the different denominations was mentioned several times. Some respondents said that it is not convenient and confusing to have several websites to search for information. I myself agree with this, as it would be extremely advantageous to bundle all material on one site, rather taking advantage of third-level domains, so that the traffic itself is also channelled to a single domain name.

Furthermore, the dedicated website https://www.chateauneuf.com does not work if one only types in http://chateauneuf.com because the necessary operation to match the results has not been carried out. This brings a disadvantage in that those who, like me, omit the www. if they do not fancy adding it when they have no results do not visit the website and are a potential lost consumer.

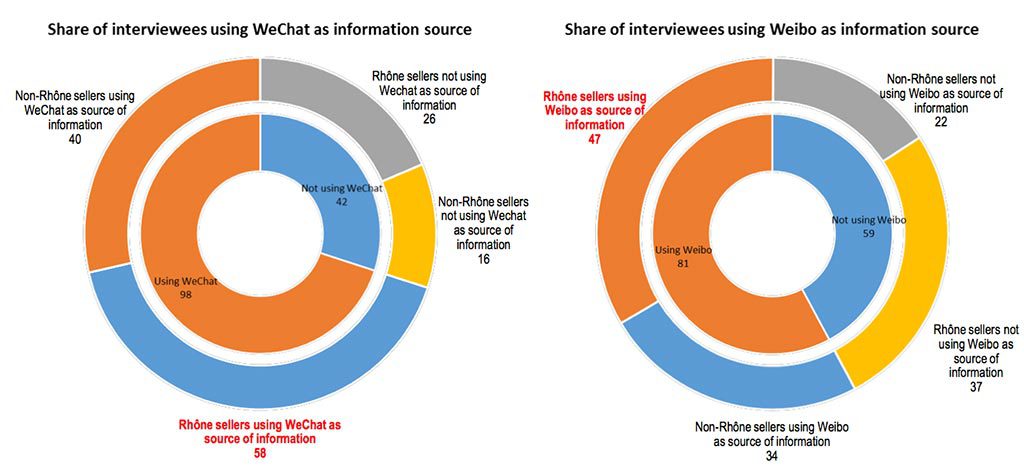

Some respondents said they prefer to use platforms such as WeChat and WeIbo to obtain information as they have easier navigation. This should be seen as a wake-up call in the strategic definition of website architecture.

The Internet is the main source of information and is closely linked to social media. Out of 140 professionals surveyed, 98 use WeChat (70%) and 81 use WeIbo (60%) to obtain information. This tells us that for a winemaking reality is fundamental:

- enhancing the website by adapting it to its objective;

- use WeChat and WeIbo tools correctly if they want to interface with the Chinese market.

Preferred wine information tools in China

These two tools are used because they are very dynamic, convenient and fast, but above all because they allow discussions to be shared quickly with one's network.

WeChat is a communication service through text and voice messages that cannot replace website consultation.

Relevant, however, is that immediately after the Internet we have word of mouth and only in third position are newspapers.

In summary...

China online is running at an extraordinary pace and it will be difficult for Italian companies that are still so hostile to the world of the web to catch up. Abandoned sites, ugly and not very usable e-commerce cannot compete with the Chinese market that has made the online its main trend. Chinese bloggers then post content all the time that has nothing to do with the rare and neglected news that our companies post. Chinese bloggers manage to get many followers in a very short time and this turns them into opinion leaders rather quickly. Content production by Italian professionals tends to be of low quality... yet we have the product!

Dear Wine Company BEWARE: placing your product with a distributor will not be enough for you to really be present on the Chinese market. To win you must:

- Having a beautiful and user-friendly website;

- Curating a blog that helps you understand wine (particularly your wine) without self-praise;

- Have an effective newsletter system;

- Organise Mini conferences with the right people and Masterclasses in the country of interest (in our case China);

- Invest in graphics, packaging and everything that revolves around strengthening the brand.

Either that, or change your focus directly and don't waste money doing anything less than that because you won't need it.

As we have seen in Daxue's research, there is a shift from high-end to mid-range. This is because there are 1.3 billion Chinese people. Approximately 9-10% lead a very affluent life (around 130 million) while the millionaires who can buy luxury labels, mainly French, are 1% (or around 1.3 million). Already today, it is no longer the exclusive brand that takes centre stage: the consumption of grand chateaus is declining while Italian wine is in the process of conquering the upper-middle class made up of over 100 million people.

If you are an Italian wine producer, you cannot ignore it: it is a market where there is numerically room for everyone as long as they know how to sell themselves and enjoy a decent quality product.

Italy is the world's largest wine producer, China is the world's largest wine consumer. Supply and demand must meet.

"Your company's most valuable asset is its image with customers." Brian Tracy

Some useful resources:

- Is your website up to the Chinese market?

- China. A thousand-year history

to better understand China and the Chinese...

- Network and social media in China

how are they used?

- Wine and China: Red Passion: A conference on the cultural heritage of Chinese and Western Wines- Bilingual edition (English Edition)

simply an extraordinary book!

- Wine marketing: From labels to social networks, the complete guide to promoting wine and food tourism (Business models)

the guide that all wineries should read in order to understand how to move within communication... and above all how not to be fooled by companies of little worth!

- Web storytelling. Building brand stories in social media (Communication Culture)

This book needs no introduction: it is fundamental and suitable for everyone. IMPERDIBLE!

Now it's your turn!

If you have had experience selling your wine in China, I would like to know your results:

- Have you ever sold your wine in China?

- If so, was it a positive experience?

- If not, why have you never tried or succeeded?

- What do you think of the Chinese market?

- Do you have a particular case study to tell?

Leave a comment!

In the hope that I have been helpful, I embrace you.

Chiara

.