In this night before exams I want to share with you the paper I did for the Geography of Wine Production course in which I got top marks. I really hope the exam goes well tomorrow... in the meantime, how about finding out together why I chose to talk about "The Franciacorta case“?

The outline of the paper I chose was: 'Considering the variables that underlie the different territorial aggregations of enterprises, as reported in the various lectures of the course, analyse a suitably chosen wine production area'.

When I read it, the Franciacorta wine district immediately came to mind. During the video lectures I remembered a concept about the role of demand that particularly struck me: a district is created to serve local demand. If we assume that over time 'local' has broadened its definition to include the Italian market, Franciacorta has a peculiarity: less than 12% of the bottles produced are exported abroad.

As a wine blogger, a job I have been doing with passion for almost 7 years, I have had the privilege of visiting over a thousand wine cellars in Italy and Europe. For the last 5 years, I have chosen to live on the edge of Franciacorta, on Lake Iseo, precisely because of its strategic location. What particularly struck me about Franciacorta, and in particular the Franciacorta Consortium, is precisely the strength of this territorial aggregation of companies in which there are about 200 members between winegrowers, winesficers and bottlers. The expressive ability to communicate the sense of belonging to an area that has become the fithe flagship of Italian sparkling wine production, cohesion in the affalso large projects - the exclusive stand at the Milan Expo in 2015, for which the Franciacorta Consortium was Official Sparkling Wine Sponsor - as well as the authority to position itself andffion a rather high price range make it a real 'case' worth investigating.

My objective is therefore to recount the path of valorisation undertaken by the Franciacorta Consortium, from its assets to the results achieved.

Night before exams talking about Franciacorta!

1. Franciacorta as a wine-growing area

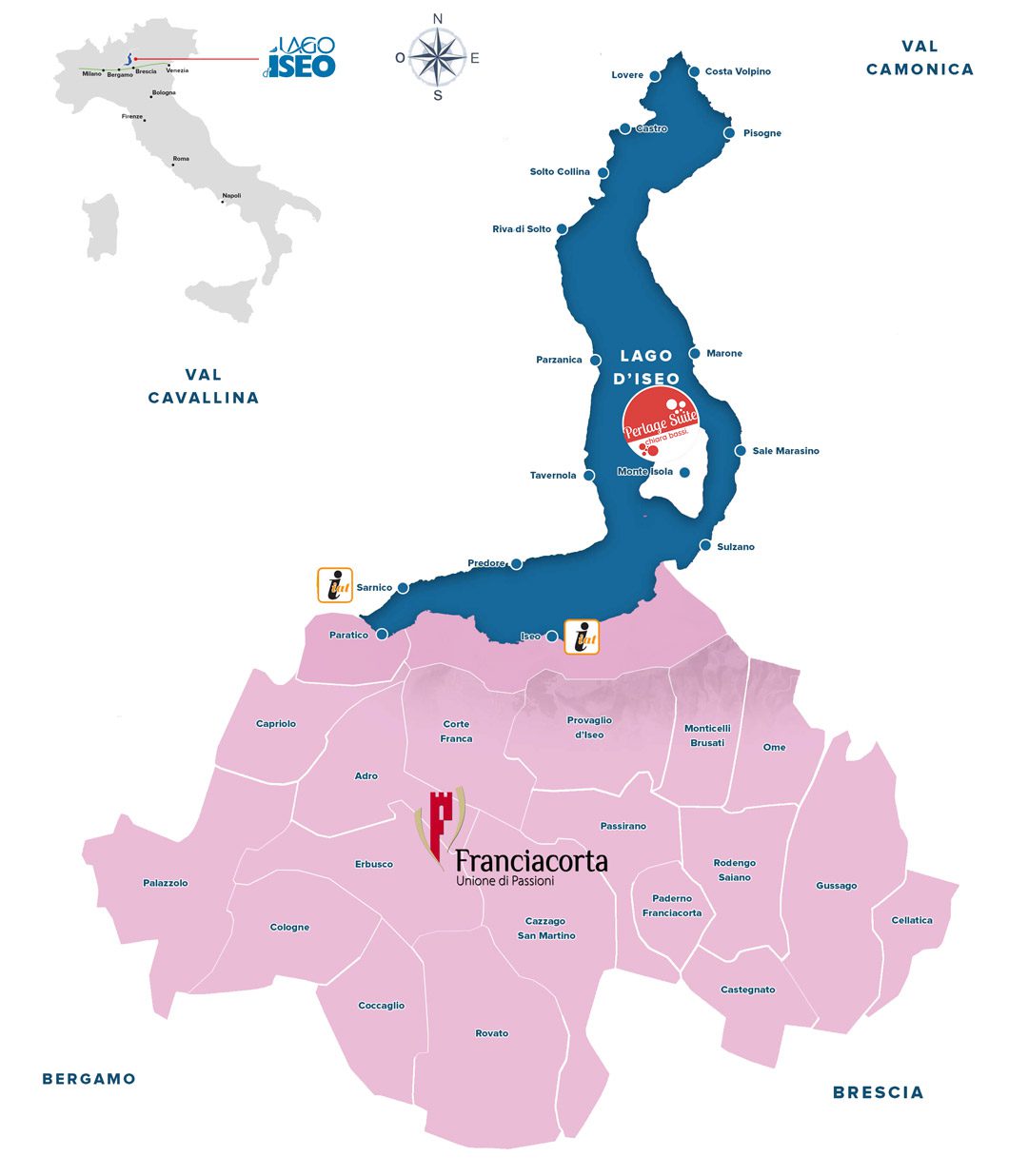

Franciacorta is a mostly hilly area nestled between Brescia and the southern part of Lake Iseo for a total area of 276 km2 covering the Brescian municipalities of: Adro, Capriolo, Castegnato, Cazzago San Martino, Cellatica, Coccaglio, Cologne, Corte Franca, Erbusco, Gussago, Iseo, Monticelli Brusati, Ome, Paderno Franciacorta, Paratico, Passirano, Provaglio d'Iseo, Rodengo-Saiano and Rovato. Its country roads, among stone villages, medieval castles, abbeys, monasteries and period residences, are lined with vineyards and cypresses neatly arranged in space. This is why the local authorities are constantly striving to safeguard the beauty of the landscape heritage.

The Franciacorta DOCG wine-growing area occupies a smaller space than this area and extends some 200 square metres to its southern border represented by Monte Orfano (451 m altitude). This sub-classification of the territory with respect to the denomination rather than the traditional area took hold in 1967 when a Decree of the President of the Republic recognised DOC Franciacorta (DOCG would arrive in 1995).

Among the world's great sparkling wine territories, Franciacorta represents a true oenographic case. Exactly as happened in Champagne, a combination of pedomorphological and anthropological factors determined the birth of the typology and consequently of the territory as we understand it today.

2. The Franciacorta DOCG

The Controlled and Guaranteed Designation of Origin 'Franciacorta' is reserved for wine obtained exclusively by re-fermentation in the bottle and separation of the deposit by disgorging, which meets the conditions and requirements laid down in the product specification2. This definition makes it clear that Franciacorta DOCG is obtained exclusively by the Classical Method.

The Franciacorta Consortium, with an effiplay on words, coined the term 'Metodo Franciacorta' to describe the DOCG specification. To understand the scope of this idea, it is necessary to make a premise and talk about how a Metodo Classico sparkling wine is produced.

2.1 The Classical Method

The Metodo Classico is obtained from the re-fermentation in the bottle of base wines, plus a series of meticulous oenological practices.

The grape varieties traditionally ideal for making base wines are chardonnay, pinot noir, pinot blanc and pinot meunier, but other indigenous grape varieties are now also used with interesting results. The bunches of grapes must not be traumatised during the harvest and transport to the cellar, which is why harvesting - for quality production - must be done by hand in small crates of a maximum of 20 kg. The bunches must be selected and the pressing must be soffice, progressive and take place quickly to extract the must fihours. In the case of base wines made from a blend of several grape varieties, this may be either with base wines from the same vintage - Spumante Millesimato, at least 85% of the grapes must come from the same vintage - or with base wines from different vintages - Cuvée.

The base wine is topped up with dosage syrup, a mixture of wine, cane sugar, yeast and mineral substances with 24 g/l sugar, which is used to start the second fermentation in the bottle. After bottling and sealing with the traditional stainless steel crown cap, the bottles are stacked horizontally in damp, dark and quiet places at a constant low temperature. The yeasts transform the sugar into carbon dioxide and ethyl alcohol and form a series of secondary substances that enrich the sparkling wine with characteristic aromas and flavours. The more time the wine spends in contact with the yeasts, the more it is enriched with aromas and the bubbles become fipersistent. The affican last from a minimum of 10 months to a maximum of 150 months depending on the type of product to be obtained.

In the final period of ageing, the bottles are placed in an upright position (manual or mechanical remuage) to bring the yeasts into the neck of the bottle, which is frozen and pressurised after uncorking. After this stage of disgorgement, the producer can choose whether to 'top up' the wine with liqueur d'expédition (a secret recipe based on aged wine, cane sugar and eau-de-vie) or top up with the same wine. The sparkling wine is then corked with the classic mushroom cork and protected by the cage, which prevents unwanted uncorking due to pressure.

2.2 The Franciacorta Method

Franciacorta DOCG is a classic method sparkling wine made from chardonnay, pinot noir, pinot blanc (max 50%) and Erbamat (max 10%) grapes. Harvesting is done strictly by hand in small crates. The bunches are subjected to soffice to obtain must fihours. This is followed by dosing, bottling and horizontal stacking. In the last period of affiremuage takes place, which may be manual or mechanical. The neck of the bottle is frozen and the bottle is uncorked. The bottle is topped up with the liqueur d'expédition (Franciacorta DOCG + sugar) or with the wine itself. The sparkling wine is then corked with the classic mushroom cork and protected by the cage, which prevents unwanted uncorking due to pressure.

2.3 A brilliant marketing operation

2.4 Large investments of and for valuable human capital

It would be wrong to merely praise Franciacorta's ability to communicate its value without specifihow it was forged by the managerial nature of its entrepreneurs who by the fin the 1960s they bought or founded the most valuable wineries. It was 5 March 1990 when a small group of visionary entrepreneurs founded the Consorzio Franciacorta and 'christened' the most restrictive specification in Europe. The human capital of the Franciacorta business network is at all levels because it is this orientation towards real and supposed quality on which the possibility of shifting competitiveness from price to more noble factors that also involve reduced productivity is based.

The district's development strategies were defibased on a number of macro-areas and mainly concern: trade and production promotion, brand protection and promotion, research and innovation, training and qualifilocal knowledge and environmental quality. In this regard, it should be noted that the first organic wine produced in Franciacorta was in 2002 (Barone Pizzini).

3. The Franciacorta consortium

Its main objective is to guarantee and control compliance with the specifications in the production of wine bearing the name 'Franciacorta' on the label.

In March 1991, the Technical Production Regulations for Franciacorta were approved and in November the Franciacorta trademark was registered in Italy.

In 1992, Franciacorta started a wine donation study.

In 1993, a new production regulation imposed only natural re-fermentation in the bottle as the method of sparkling wine making, the term 'Metodo classico' was eliminated, and the grape production area was made compulsory.

In 1995, the consortium logo became the only identification of Franciacorta DOCG, the first Italian brut to obtain recognition. In September of the same year, the Consortium approved the production regulations for Franciacorta DOCG.

In 1996, the wine code was approved. This is a self-regulation that represents an evolution of the technical-productive regulation, which is more restrictive than the product specification.

In 2000, the 'Strada del Franciacorta' and the 'Festival del Franciacorta' were created with the common objective of promoting and developing the tourism potential of Franciacorta. The ability of businesses to 'network', to coordinate in various ways to achieve a specific finality as a long-term strategic importance, but also as a tactic for the immediate future: this is one of the winning characteristics of Strada del Franciacorta.

In 2010, new restrictive indications were introduced into the Franciacorta production regulations, increasing production rigour in the name of the best quality and confirming the Franciacorta method as the strictest in the world for this type of wine.

In cooperation with university institutes, local authorities and environmental protection associations, the Consortium promotes and oversees projects to protect the historical, artistic and wine-growing heritage of Franciacorta. The direct knowledge and territorial proximity of the actors involved made it possible to 'streamline' the network contract and create a truly effition in both the control and promotion phases.

3.1 'Very Italian, Very Franciacorta!' an Italian lifestyle ads campaign.

For its 30th anniversary, the Franciacorta Consortium has created a new adversiting campaign The praise of beauty, the passion for the terroir, the pride in the Italian lifestyle, the ability to reap quality results: these are some of the values on which the message of the new Franciacorta campaign is based, Very Italian, Very Franciacorta, firyed for the occasion by renowned Italian photographer Marco Craig. Two shots that bring to life the emotional and sensorial Franciacorta and encapsulate its true essence, that of an Italian lifestyle par excellence and recognised the world over.

4. The Franciacorta Economic Observatory

In 50 years, Franciacorta DOCG has been able to penetrate the Italian market without competing on price. The Franciacorta Economic Observatory is the first and only instrument for collecting and analysing reliable data in the Italian wine sector. The realisation of such an ambitious project clarifies the avant-garde nature of this network of companies that wants to keep pace with consumer demands by developing coherent strategies that have emerged after studies and research on data andffectionally collected.

.

5. Competitiveness of Franciacorta in Italy and the World

The significant growth in international wine trade has also created new business opportunities for Italian operators: in the last 10 years +68.5% in value and +6.2% in volume. This figure speaks of a price repositioning of Italian wines marketed abroad4. In the last year it was sparkling wines that drove Italian exports, in particular another famous appellation: Prosecco.

As far as Franciacorta DOCG is concerned, the volume of the domestic market, at 88.7%, is stable compared to the previous year. As far as exports are concerned - which make up the remaining 11.3%, with a growth rate of 2.7% - at the level of individual countries, we have Switzerland in the lead, which confirms its supremacy, accounting for 18.4% of total exports, with a slight increase.

Japan follows close behind, accounting for 17.8% of total exports in 2019, regaining positive growth rates compared to the first part of the year. It is followed by Germany (12.6% of total exports), the United States (12.0% of total exports), Belgium (5.0% of total exports) and the United Kingdom (4.1% of total exports).

All the main export destination countries are growing, with the exception of Germany which, in the period considered, shows a decrease in terms of volumes offset by a growth in average price and a more stable situation in terms of turnover. Although with a smaller incidence on total exports, the growth performance of other countries, such as Russia, China and the Netherlands, is also interesting.

Globally, the average price of an equivalent bottle, indistinct by type, stood at fine 2017 to €12.57 excluding VAT to €13,14 a fiin 2018 and growing further to €13.39 in 2019.

Bibliography and sitography

-

Nomisma Wine Monitor (2018). Wine Marketing, Scenarios, International Markets and the Competitiveness of Italian Wine. Agra, Rome.

-

Bentivogli Chiara, Quintiliani Fabio, Sabbatini Daniele (2013). Le reti d'impresa. Questioni di economia e finanza n°152. Bank of Italy, Rome

-

Archetti Gabriele (2019). The origins of Franciacorta in the Italian Renaissance. Consorzio Franciacorta, Brescia

-

Martiniello Laura, Tiscini Riccardo (2014). Network contracts and districts: relations under organisational, accounting and tax profiles. Universitas Meracatorum, Rome

-

Bassi Chiara (2019). How to become a Sommelier. De La Paix Edizioni, Rome

My night before exams ends here. I hope to uncork something tomorrow to celebrate... alternatively I'll do it to forget!

Cheers

Chiara